Fascination About Short Term Loan

Wiki Article

The Best Strategy To Use For Short Term Loan

Table of ContentsGetting The Short Term Loan To WorkExcitement About Short Term LoanAll About Short Term LoanShort Term Loan - QuestionsShort Term Loan for DummiesRumored Buzz on Short Term Loan

In situations like these, many individuals rely on short-term financings or short-term financing as a means to spend for unexpected or difficult personal expenditures. Short-term financing is a funding alternative that provides the recipient obtained funds for short-lived expenses, similar to just how a short term finance functions!.?.!? Short term lendings provide you borrowed resources that you repay, plus rate of interest, usually within a year or less.A massive advantage of short-term financing is that they can make a huge distinction for individuals that require immediate access to money they do not have. Short-term lending lenders do not place a massive emphasis on your credit report background for authorization. More crucial is proof of employment and a stable earnings, info regarding your financial institution account, and also confirming that you do not have any kind of outstanding lendings.

A number of types of short term car loans offer impressive flexibility, which is helpful if cash money is limited today however you expect things improving financially quickly. Prior to signing for your short-term car loan, you as well as the lender will make a timetable for settlements and accept the passion prices in advance.

Short Term Loan Can Be Fun For Everyone

The advantage of temporary financing is that you obtain a relatively small amount of money right now, and you pay it back promptly (Short term loan). The overall passion paid back will typically be a lot less than on a larger, lasting lending that has even more time for interest to develop. No economic service is excellent for each customer.

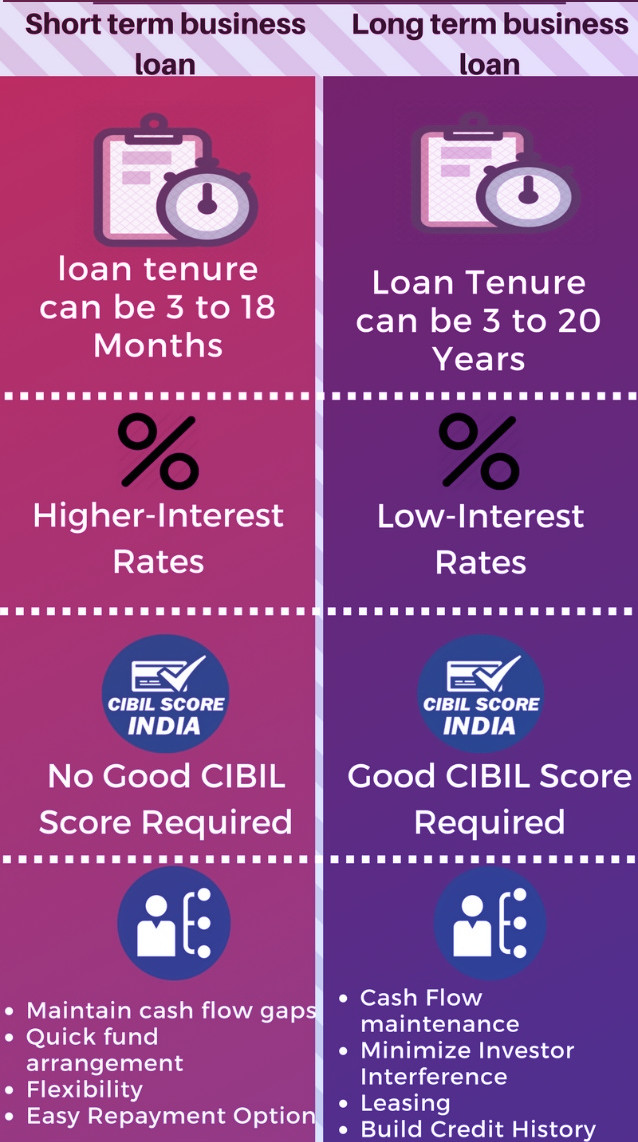

This is why it is necessary to evaluate your alternatives in order to set on your own up for success. Take a look at the 3 top disadvantages of securing a short term loan. The largest drawback to a short-term finance is the rates of interest, which is higheroften a lot higherthan rate of interest for longer-term financings.

Little Known Facts About Short Term Loan.

On top of paying back the short-term lending balance, the passion settlements can cause higher repayments every month (Short term loan). Maintain in mind that with a temporary finance, you'll be paying back the lending institution within a brief period of timewhich means you'll be paying the high interest for a much shorter time than with a lasting loan.Lasting car loans may have lower rates of interest, yet you'll be paying them over several years. Depending on your terms, a temporary finance may in fact be more affordable in the lengthy run. While paying back a short-term financing in a timely manner according to your set schedule can be a substantial increase to your credit report score, falling short to do so can trigger it to drop.

This can be damaging if you just have a little or good credit rating, and ruining to your future potential to borrow if you currently have poor credit. Prior to taking out a short-term loan, be straightforward with yourself regarding your ability as well as discipline when it involves paying back the lending helpful site in a timely manner.

Short Term Loan Fundamentals Explained

There are numerous advantages as well as negative aspects of short-term financing. Thinking about the leading advantages as well as negative aspects of short-term lendings will certainly assist you decide if this monetary tool is best for your circumstance. If you have any kind of more questions, be sure to contact Power Finance Texas today!.? .!!. A temporary funding is a financing that the consumer requires to pay back, along with rate of interest, in a reasonably brief duration, normally in a year. The debtor returns the quantity of the funding to the lending institution throughout months instead of years. If you remain in urgent need of funds to fund a acquisition, you can quickly look for a loan either online or with a financial institution or lending institution.

click now The demands for using for a car loan are: The debtor ought to be 18 years or above Valid e-mail address as well as phone number Although these are some of the demands that you may require to look at here now fulfill before requesting a lending, you do not require to have security while using for a car loan.

The Best Strategy To Use For Short Term Loan

There are lots of advantages connected with short-term car loans. Let's discuss them to help you understand how advantageous these car loans can be.

As you are using for a temporary funding, you must be positive adequate to repay it in the needed timeframe. Individuals of temporary loans commonly acquire lines of credit rating.

Examine This Report on Short Term Loan

Many lending institutions run sites that you can go to directly to use for a loan promptly. Given that you have to repay the lending within a brief duration, the tension associated with settling it will not last for long!You can simply look for a loan as well as repay it as quickly as you make enough earnings.

Report this wiki page